In the ever-evolving landscape of financial technology, error codes can often be a thorn in the side of both users and developers. One such enigma that’s been causing quite a stir is Error Code FintechAsia.

This comprehensive guide aims to shed light on this perplexing issue, offering insights into its causes, implications, and solutions.

Whether you’re a fintech enthusiast, a developer grappling with system glitches, or a user trying to navigate the choppy waters of digital finance, this article will equip you with the knowledge to tackle Error Code FintechAsia head-on.

What is Error Code Fintech Asia?

Error Code FintechAsia is a specific identifier used in the realm of financial technology to pinpoint a particular type of system malfunction or issue. This error code often rears its head when users interact with fintech platforms, financial apps, or related services.

It’s important to note that Error Code FintechAsia isn’t a one-size-fits-all solution; rather, it serves as a diagnostic tool for developers and technical support teams to zero in on the nature of the problem.

When this error crops up, it’s akin to your fintech application waving a red flag, signaling that something’s amiss in the intricate web of financial technology services.

Understanding this error is crucial for maintaining the smooth operation of fintech systems and ensuring user satisfaction in an industry where trust and reliability are paramount.

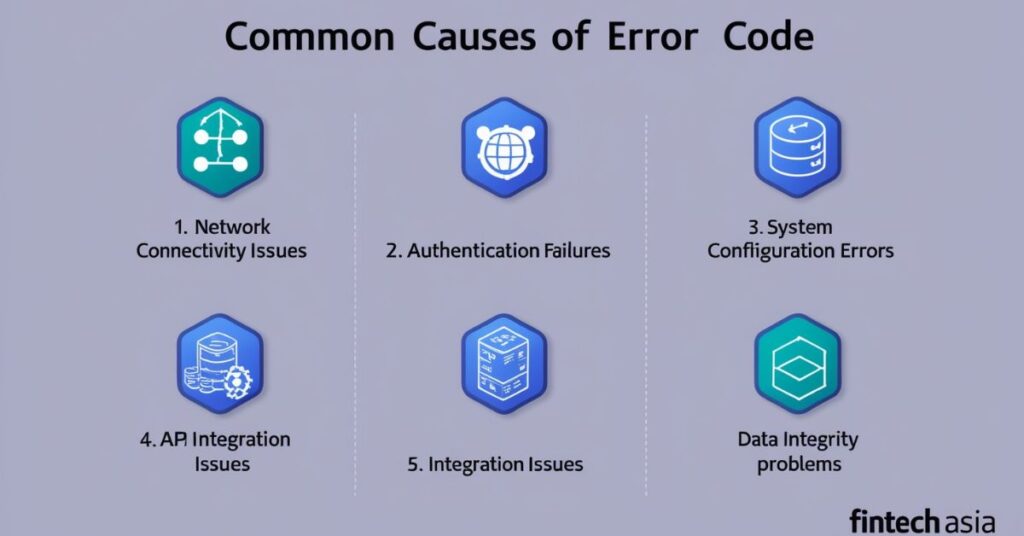

Common Causes of Error Code Fintech Asia

Let’s dive into the nitty-gritty of what typically triggers Error Code FintechAsia. By understanding these root causes, we can better equip ourselves to prevent and resolve issues in fintech applications.

1. Network Connectivity Issues

In the fast-paced world of fintech, where split-second transactions and real-time data exchanges are the norm, network connectivity is the lifeblood of operations.

Error Code FintechAsia often emerges when there’s a hiccup in this vital flow of information. Common culprits include:

- Unstable internet connections

- Server downtimes

- Problems with intermediary network devices

These issues can disrupt the seamless communication between fintech platforms and their users, leading to transaction failures and data sync problems.

2. Authentication Failures

Security is paramount in financial technology, and authentication is the first line of defense. When this fortress is breached, Error Code FintechAsia may appear as a warning signal. Authentication failures can stem from:

- Incorrect user credentials

- Issues with the authentication server

- Expired or revoked access tokens

These failures not only trigger the error but also raise red flags about potential unauthorized access attempts.

3. System Configuration Errors

The intricate dance of software and hardware in fintech systems requires precise configuration. When these settings are out of step, Error Code FintechAsia might pop up. Configuration errors can result from:

- Recent software updates

- Changes in system requirements

- Incorrect setup during installation or maintenance

Misconfigurations can lead to a domino effect of issues, disrupting the entire fintech ecosystem.

4. API Integration Issues

APIs (Application Programming Interfaces) are the unsung heroes of fintech, enabling different systems to communicate and share data. When these bridges falter, Error Code FintechAsia often follows. Common API-related problems include:

- Malfunctioning API endpoints

- Incompatible data formats

- Outdated API versions

These issues can severely impair the functionality of fintech applications, leading to incomplete transactions and data discrepancies.

5. Data Integrity Problems

In the world of finance, data is king. When the integrity of this data is compromised, Error Code FintechAsia may be triggered as a warning sign. Data integrity issues can arise from:

- Errors in data entry

- Flaws in database management

- Glitches in data synchronization processes

These problems can lead to inaccurate financial records, misreported transactions, and a host of other issues that undermine the reliability of fintech services.

Implications of Error Code Fintech Asia

Understanding the consequences of Error Code FintechAsia is crucial for both users and developers in the fintech space. Let’s explore the ripple effects this error can cause.

1. Disruption of Services

When Error Code FintechAsia strikes, it often leads to a domino effect of service interruptions. Users may find themselves unable to:

- Complete financial transactions

- Access account information

- Utilize specific features of the fintech application

For businesses, these disruptions can translate into lost revenue, decreased customer satisfaction, and potential damage to their reputation in the competitive fintech market.

2. Security Concerns

Error Code FintechAsia can sometimes be a harbinger of more serious security issues. When the error is linked to authentication failures or data integrity problems, it raises concerns about:

- Potential unauthorized access to financial accounts

- Data breaches compromising sensitive financial information

- Vulnerability to cyber attacks targeting fintech platforms

These security implications underscore the importance of swift and thorough resolution of the error to maintain the trust and safety of fintech users.

3. Development and Maintenance Challenges

For the tech teams behind fintech platforms, Error Code FintechAsia presents a unique set of challenges:

- Diagnosing the root cause often requires extensive investigation

- Resolving the issue may involve debugging complex code

- Coordinating with multiple teams or external service providers

These challenges can strain resources and potentially delay the rollout of new features or updates to fintech applications.

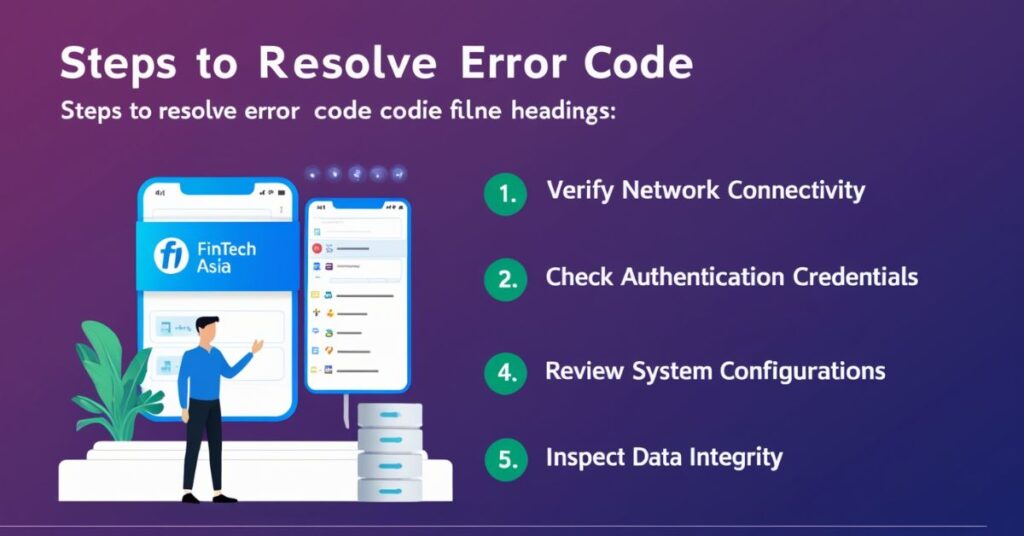

Steps to Resolve Error Code Fintech Asia

Tackling Error Code FintechAsia requires a methodical approach. Here’s a step-by-step guide to help users and developers navigate through the resolution process.

1. Verify Network Connectivity

Start by ensuring that your internet connection is stable and robust. Here’s a checklist:

- Run a speed test to check your internet bandwidth

- Verify that there are no ongoing service outages with your ISP

- Check if other devices on the same network are experiencing issues

If network problems persist, consider reaching out to your internet service provider for assistance.

2. Check Authentication Credentials

Authentication issues are often at the heart of Error Code FintechAsia. Follow these steps:

- Double-check your login credentials for accuracy

- If possible, reset your password and try logging in again

- Ensure that your account hasn’t been locked due to multiple failed login attempts

For developers, it’s crucial to verify that the authentication servers are functioning correctly and that all security certificates are up to date.

3. Review System Configurations

Incorrect system settings can trigger Error Code FintechAsia. Here’s how to address this:

- Review all configuration files for any recent changes

- Ensure that system settings align with the required parameters

- Check for any recent software updates that might have altered configurations

Developers should maintain a log of configuration changes and consider implementing a rollback mechanism for quick recovery.

4. Test API Integrations

For issues related to API integrations, follow these steps:

- Verify that all API endpoints are accessible and responding correctly

- Check that the data formats being sent and received are compatible

- Ensure that API keys and authentication tokens are valid and not expired

It’s also advisable to review API documentation and consider reaching out to the API provider for support if issues persist.

5. Inspect Data Integrity

Addressing data integrity issues involves a thorough examination of your fintech system’s data:

- Run data validation checks to identify any inconsistencies

- Review recent database transactions for any anomalies

- Ensure that all data synchronization processes are functioning correctly

For critical financial data, consider enlisting the help of a database expert to perform a comprehensive audit.

Preventing Future Occurrences of Error Code FintechAsia

An ounce of prevention is worth a pound of cure, especially when it comes to fintech errors. Here are proactive measures to minimize the occurrence of Error Code FintechAsia:

1. Regular System Maintenance

Implement a robust maintenance schedule:

- Perform routine checks on all system components

- Keep software and security patches up to date

- Regularly review and optimize system configurations

2. Robust Security Measures

Strengthen your fintech platform’s defenses:

- Implement multi-factor authentication

- Use encryption for all data transmissions

- Conduct regular security audits and penetration testing

3. Comprehensive Testing

Develop a rigorous testing protocol:

- Perform thorough testing before deploying any updates

- Simulate various scenarios that could trigger Error Code FintechAsia

- Implement automated testing tools for continuous quality assurance

4. Effective Monitoring and Alerts

Stay ahead of potential issues:

- Set up real-time monitoring for all critical systems

- Implement alerts for specific error codes, including Error Code FintechAsia

- Use predictive analytics to identify potential problems before they escalate

5. User Education and Support

Empower your users with knowledge:

- Provide clear documentation on common error codes and troubleshooting steps

- Offer accessible customer support channels for quick issue resolution

- Conduct regular user training sessions on best practices for using your fintech platform

By implementing these preventive measures, fintech platforms can significantly reduce the occurrence of Error Code FintechAsia and other system errors, ensuring a smoother, more reliable experience for users.

Read Also: Understanding Skylar Vox’s Weight Gain

Conclusion

Error Code FintechAsia, while challenging, is not an insurmountable obstacle in the world of financial technology. By understanding its causes, implications, and resolution steps, both users and developers can effectively address this error and minimize its impact on fintech services.

As the financial technology landscape continues to evolve, staying informed and prepared will be key to navigating and resolving issues like Error Code FintechAsia.

Remember, in the fast-paced world of fintech, adaptability and proactive problem-solving are your best allies in ensuring smooth, secure, and efficient financial operations.

FAQs

What triggers Error Code FintechAsia?

Common triggers include network issues, authentication failures, system misconfigurations, API integration problems, and data integrity concerns in fintech applications.

How can I quickly resolve Error Code FintechAsia?

Start by checking your network connection, verifying login credentials, and reviewing recent system changes. If issues persist, contact your fintech provider’s technical support.

Is Error Code FintechAsia a security risk?

While not always a direct security threat, it can indicate vulnerabilities. Promptly addressing the error is crucial to maintain the security of your financial data.

Can Error Code FintechAsia affect my financial transactions?

Yes, it may disrupt ongoing transactions or prevent new ones. Always verify transaction status and account balances after encountering this error.

How can developers prevent Error Code FintechAsia?

Implement regular system maintenance, robust security measures, comprehensive testing, and effective monitoring. Also, provide clear user education and support resources.

Admin (Quorasinfo) is an authority in the realm of celebrity insights, recognized for providing precise and engaging profiles of prominent figures. With a deep understanding of public personas and their influence, Quorasinfo sheds light on the personal and professional journeys of celebrated individuals, creating a bridge between celebrities and their fans. Through meticulously crafted articles, Quorasinfo offers readers a meaningful look into the dynamics of fame and its cultural impact, making it a go-to source for anyone intrigued by the world of celebrities.